what to do in ct if recieved workmans comp form 43

There are four bones types of workers' comp benefits paid past insurance companies

Workers' compensation benefits are the payments an insurance company makes to the insured's injured employee, or some other related political party, based on the terms of the insurance policy. Types of payments include:

- Medical benefits

Pays for necessary medical care to treat work-related injuries or illness.

- Income benefits (disability benefits)

Replaces a portion of any wages lost because of work-related injury or illness.

- Death benefits

Pay a portion of lost family income for eligible family members of employees killed on the job.

- Burial benefits

Pays for some of a deceased employee'south funeral expenses.

Workers' Compensation Medical Benefits

Medical benefits are are payments fabricated for the medical treatment of a work-related injury or disease. Their is no maximum threshold for medical benefits. Insurance companies will not pay for the treatment of other injuries or illnesses unrelated to the chore injury, fifty-fifty if the treatment was provided at the same time as the treatment for a work-related injury. Wellness care provider should not bill the carrier for treatment related to a piece of work-related injury or illness, but may bill you for treatment of other injuries or illnesses.

All employees have the right to receive necessary medical treatment immediately after the work-related injury or disease. If the business organization has elected to contract with a certified workers' compensation health intendance network (network), injured workers may be required to obtain medical treatment through the network

A doctor may only request payment from you or the carrier when the work-related injury or illness has been reviewed by a case managing director for dispute resolution, and the injury has been adamant to exist an injury or illness that is work-related.

It generally beneficial to all parties if injured employees return to work equally speedily as possible. Injured employees that proceed to work every bit part of their recovery/handling plan, in medically appropriate productive work, heal faster, and are more likely to retain their chore skills. There is not always a specific terminate date for reasonable and necessary medical treatment for a work related injury. Getting employees back to piece of work often costs less and helps reduce long-term insurance premiums caused by increased EMR Rating.

Workers' Comp Disability Benefits

Disability benefits are also known every bit supplemental, income and cash benefits. In that location are four types of income benefits:

- Temporary income benefits

- Impairment income benefits

- Supplemental income benefits

- Lifetime income benefits

How much does workers comp pay for lost wages?

Injured workers' volition more often than not receive 66 two/3% of their boilerplate weekly wage for temporary income or lost wages. Withal, the amount is capped by the state's average weekly wage. For case, in Due west Virginia, the average weekly wage is $586. This would be the maximum corporeality paid to an injured employee out of work due to a inability.

Employees must report any income (other than income benefits they may be receiving) to the Sectionalisation of Workers' Compensation and the insurance carrier so an adjustment tin be fabricated to your income benefit payments. Employees may be fined and/or charged with fraud if they receive temporary income benefits while too receiving wages from an employer without notifying the Partition of Insurance and the insurance carrier.

Income benefits are no longer payable following the death of an injured employee receiving income benefits. The injured employee's beneficiaries may be eligible to apply and receive death benefits if the injured employee'due south expiry was due to the work-related injury or illness.

How long will workman's comp pay?

Most disability payments are capped betwixt ii-4 years if the disability is temporary. Permanent Total Disabilities (PTD) can pay out to age 65 or pay a lump sum settlement. Permanent Partial Disabilities (PPD) volition pay out less coin than PPT'south, only they may pay out for life or pay a lump sum settlement.

Workers' Comp Expiry Benefits

Decease benefits can replace a portion of lost family income for dependents and eligible family members when an employee is killed on the job. Benefits may also be payable to parents when there are no surviving eligible dependent family unit members.

A beneficiary becomes eligible for expiry benefits the day later the employee's expiry. Expiry benefits cease at different times depending on the beneficiary's qualifications to be entitled for this benefit. Death benefits may be paid if there is an eligible:

- Surviving spouse

- Dependent child

- Dependent grandchild

- Other eligible dependent family members such as parents may be eligible when at that place are no other surviving eligible dependent family members

Eligible Beneficiaries:

- A spouse is ordinarily eligible to receive decease benefits for life unless he/she remarries. Upon remarriage, the insurance carrier will typically pay a ii (ii) year (104 weeks) lump sum payment

- If there are modest children, the benefit is divided betwixt the spouse and the pocket-sized children. One half is paid to the spouse and the other one-half is divided equally amid the children

- Eligible children can usually receive decease benefits until historic period 18 (18) or 20-5 (25) if enrolled as a full time educatee in an accredited college. If in that location is more than one minor child, as a child loses eligibility the benefits are re-distributed amidst the other eligible children

Burial Benefits Covered past Workers Bounty

Burial benefits are paid to the person who paid the deceased employee's burial expenses. The maximum burial benefit allowed is normally between $4,000 and $12,500 depending on individual land law.

A beneficiary becomes eligible for decease benefits the solar day after the employee'southward death.

Workers' Comp and Disability

Don't confuse disability insurance with workers' compensation disability payments. When you buy inability coverage you are buying an insurance product that pays a set amount of lost wages for injuries that happen off the clock. In other words, a disability insurance policy does not pay for injuries that would be compensable under workers' comp insurance. Conversely, workers' compensation insurance will not supervene upon amy lost wages if an employees' injury was sustained outside of piece of work.

It is not uncommon to see workers' comp claims where an injured worker claims they were injured at work even though the injury happened over a weekend. This blazon of fraud is oft caught and employees can be fined and required to repay the insurance company.

At that place are three types of disabilities nether workers' compensation insurance:

- Temporary Total Inability (TTD) Benefits

- Typically requires a waiting period of three-vii days to be eligible

- Pays upward to 66 2/three% of wages up to country weekly boilerplate (changes each year)

- Pays for a set amount of time which varies by state

- Permanent Total Disability (PTD) Benefits

- Pays up to 66 2/iii% of wages up to state weekly average (changes each year)

- May pay upwards to age 65 in most states

- Permanent Partial Inability (PPD) Benefits

- Pays upwardly to 66 2/iii% of wages up to state weekly average (changes each year)

- May pay upward to life in some states

Workers' Compensation Settlements

More than 70% of injured workers who receive disability end upwardly with a workers' compensation settlement. The average settlement amount is cryptic considering its negotiated based on numerous factors including medical costs, lost wages, scarring, deformation, degree of damage, hereafter risks and more than. Insurance companies often pursue settlements in order to receive future indemnification from the injured worked. In order to receive a settlement, an injured workers typically has to give up their rights to seek hereafter damages from the insurance visitor and the employer.

The Business Owners' Role in Settlements

Settlement negotiations typically happen between the injured employee, their chaser and the insurance company. Employers should seek to exist as helpful as possible, but business owners should remain neutral as the results are outside of their influence. While the price of claims can bear on an employers' experience modification charge per unit, business owners need to let the insurance companies do their job and mitigate future liability for both parties.

Often Asked Questions- Workers' Comp Benefits

Tin can an employer abolish your wellness insurance while on workers' compensation?

No. An employer should non cancel and injured workers health insurance because they are 2 separate coverages. Employers are required by police force to maintain the same level of health insurance benefits for a minimum of 12 weeks in nigh states.

Does workers' comp touch social security retirement benefits?

Yes it tin. Retired employees may not be able to receive the full amount of both. SSDI will commonly offset and be reduced based on a workers' comp settlement or do good payments. An injured worker who becomes seriously disabled for more than 12 months, or permanently disabled, may exist entitled to the payment of monthly Social Security benefits.

Can I choose my own md for workers' comp?

States are divided on this. Many states let the employer and insurance company to direct medical and choose the treating md. In some states like California, employees can provide written notice topredesignate who will treat then if the go injured. This can simply be done if the employer provides a group health insurance programme. A few states do allow injured workers to direct their own care.

How much is a typical workers' comp settlement?

There is nothing typical about a workers' comp settlement because each example is unique. The boilerplate settlement ranges from a few grand dollars up to $50,000 in the United States.

How long does it have to go workers comp settlement check?

A settlement often takes several months in one case an attorney is involved. Without an attorney settlement oftn happen as the medical portion of the claim is coming to an end. In one case a settlement is reached, insurance companies typically pay the settlement in 30-lx days from signing the agreement.

How long does information technology have for workers' comp to kicking-in?

Workers' comp coverage is firsthand with regard to medical expenses related to an insurance claim. Payments for lost wages by and large crave a minimum of iii days before lost wages will be replaced. Checks are usually send every ii weeks so it may take upwardly to 3 weeks to receive the first check.

How often do you become workers' comp checks?

Most insurance companies issue disability payments on a weekly footing. Almost state laws indicate that injured workers should exist paid at the sam frequency every bit they were paid commonly. Insurance companies typically ignore this rules to reduce the authoritative costs of weekly payments.

Can I go shopping while on workers' comp?

Injured workers are free to live their normal life while off work. Shopping is non very strenuous and does not bear witness an employee is capable of performing their normal work duties. It is legal for insurance companies to have investigators monitor some injured workers' when they suspect the potential for fraud. Soft-tissue injuries are specially difficult to validate. There are countless examples where injured workers were filmed playing physical sports or lifting heavy object in their yard. Insurance tin be a cat and mouse game sometimes- unfortunately.

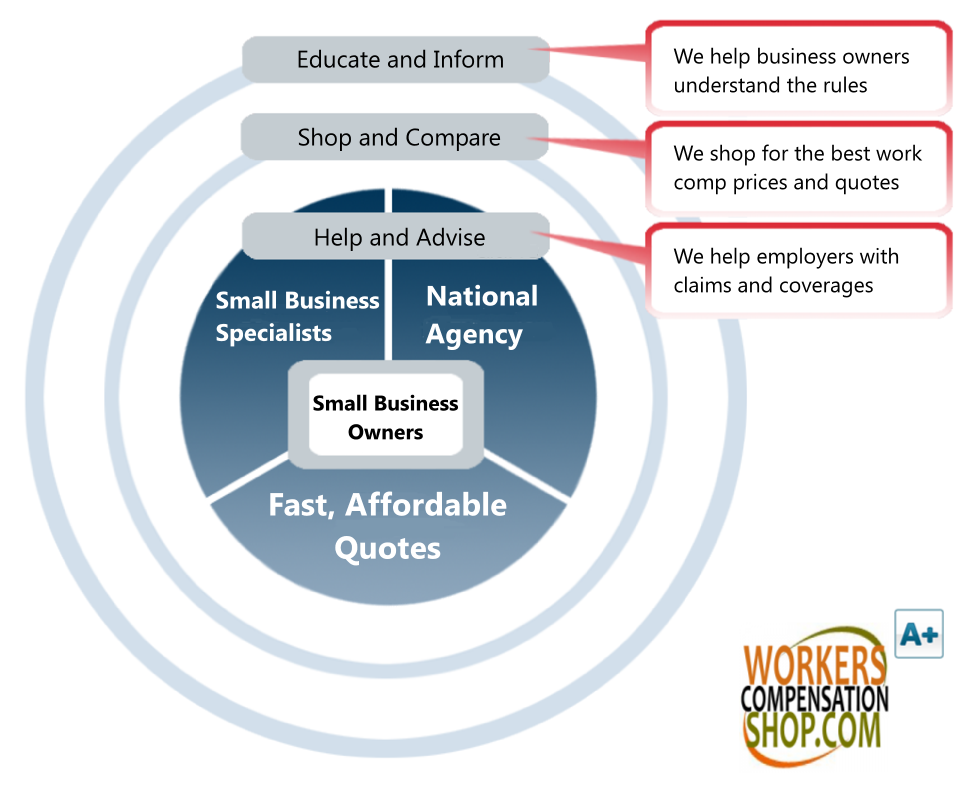

Workers Comp for Small-scale Business Owners

Save 30% on work comp for select businesses

MMI represents an injured workers Maximum Medical Improvement. In other words, MMI is defined as the indicate in the treatment process where the injured workers' medical condition is stable and no additional functional comeback is expected by the treating medico.

Insurance companies will typically terminate disability payments one time an individual achieves maximum medical improvement. Business organization owners and injured employees may request an IME (Independent Medical Exam) with the insurance company or appeal to u.s.a. Department of Workers' Compensation if the company denies the IME. The insurance visitor may also offer a workers' comp settlement once MMI is reached.

Pay As You lot Go

See how Pay As You Go coverage helps with business cashflow.

PayGo Programme

Injured employees who remain off piece of work longer than is medically necessary are more likely to:

- Develop complications that will lengthen their recovery

- Become depressed

- Focus on their pain and injury

- Lose concrete conditioning

- Have higher claim costs

Employer should consider offering a Return to Work program when possible. Return to Piece of work is set by an employer to assistance injured employees go back to work quickly and safely while they heal. This tin be done past either making changes to their regular chore or placing them in a temporary or alternating piece of work consignment that fits the restrictions every bit adamant by their treating doctor. Employers should invest the time and effort in developing a Return to Work Programme when possible.

Get a free insurance comparing today and see if your business organization qualifies for lower rates.

An Impairment is a problem affecting a person and their ability to part usually. Impairments tin exist physical or mental, also every bit temporary or permanent. When an injured workers is determined to have a permanent impairment, they are required to undergo an contained medical review in club to evaluate the degree of damage in order to determine the length of disability payments or the settlement amount.

Am impairment rating is generally needed later and injured workers has been on disability for 104 weeks. The rating is a numerical rating betwixt 0% - 100%. This number affects how long a person will remain eligible for benefits and hoe much cash payout they can receive.

An impairment rating to a higher place l% is considered to be a total disability. A rating below 50% is non a total disability. Each per centum point of impairment is mostly equivalent to 2 - half-dozen weeks of the states temporary full disability payments. The higher the percentage rating, the more than weeks each bespeak is valued at due to the long-term consequences to earning potential.

Starting time your quote online or call u.s.a. at 888-611-7467 to speak with a Workers' Compensation Specialists

We store workers' bounty with more than than 50 insurance companies

Source: https://www.workerscompensationshop.com/workers-compensation-benefits

0 Response to "what to do in ct if recieved workmans comp form 43"

Post a Comment